A Study: The Changing Landscape in Advertising and Media

Consumers are concerned about how their data is being used, and advertisers often don’t know what they are buying, where, and if their spending is impactful. This degraded consumer trust and lack of transparency in the digital world has led to a search for control. Big technology platforms are responding by restricting cookies in their browsers, and governments around the world are passing laws and instituting new regulations to protect consumers.

This means that the practices used for years in the industry are no longer sustainable, and data in advertising is breaking. Overall, advertisers have three categories of concerns: consumers’ brand trust; campaign performance and measurement; and transparency and efficiency of the buying process.

A survey conducted by the Permutive and AdExchanger captured leading brands. The study found that 98% of advertisers are concerned about online privacy and identity changes negatively impacting customer and audience trust.

This loss of trust is prompting consumers to opt out of tracking or use ad blockers. Nearly 40% of online users are browsing in cookie-less environments. Other research conducted shows that 75% of consumers are not comfortable purchasing from brands with poor data ethics.

With consumers increasingly exercising their choice to opt out of sharing their personally identifiable information is impacted.

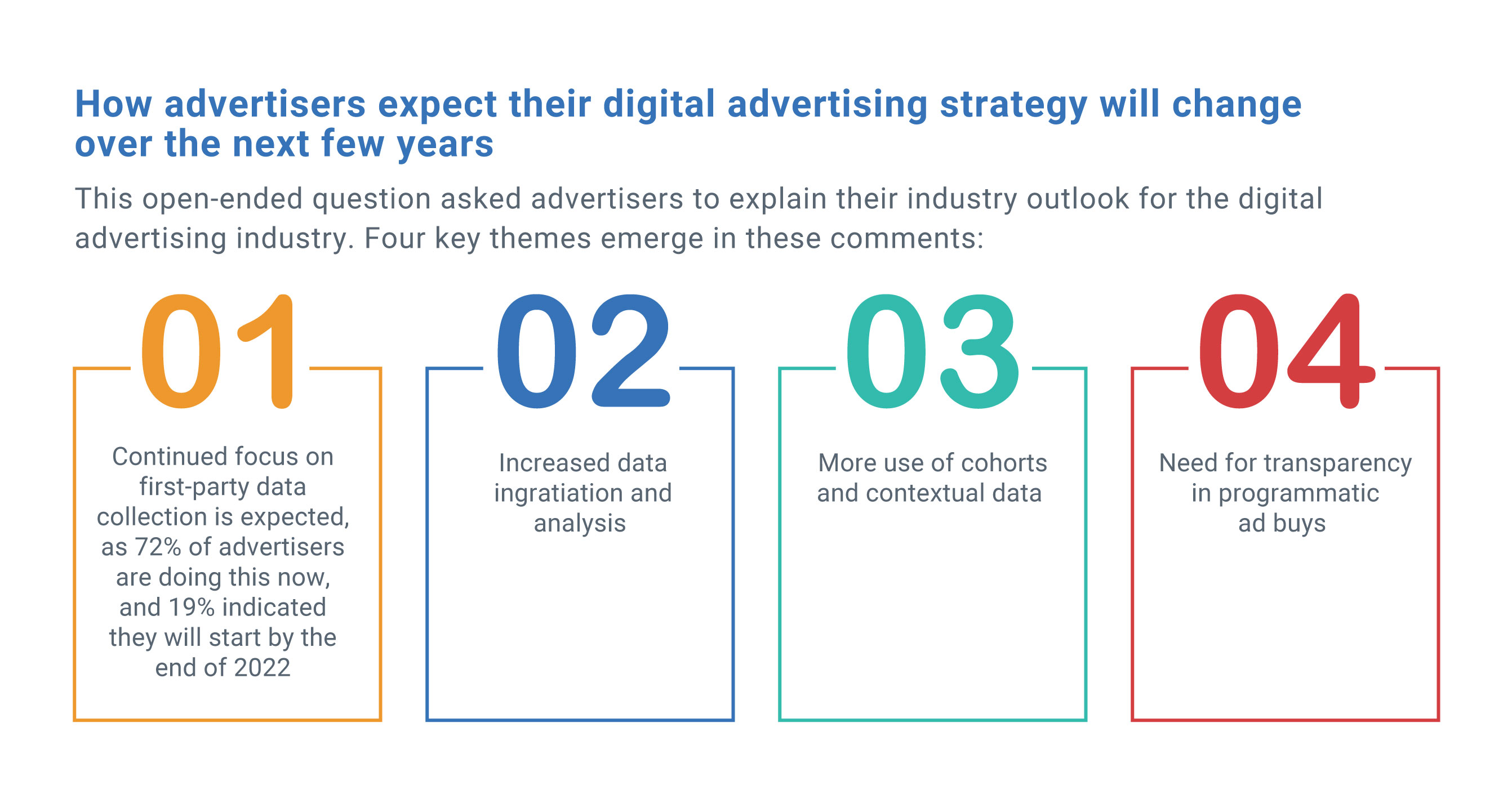

The focus is to build sustainable campaigns

Policy changes around online privacy, user identity, and the loss of third-party cookies are resulting in too many advertisers lacking full transparency in segments of their digital ad buys, and their ability to measure online campaigns effectively is at risk.

In response, advertisers are building more direct relationships with customers and publishers and capturing more first-party data. They are focusing on accessing better data and analysis in combination with more effective advertising messaging and content, all with an eye to controlling costs and boosting ROI.

To counter data depreciation, 53% of advertisers are building more direct customer and publisher audience relationships, 49% are gathering and analyzing more first-party and contextual data, and 49% are revising their strategies and tactics. Related to these findings is that 42% of advertisers noted one of their approaches is more direct communication about data consent to their customers and audiences.

Actions taken to deal with issues around privacy, user identity, and loss of third-party cookies

The main actions advertisers have taken have been around collecting more first-party data (81%) and using others’ first-party data (64%). Advertisers have been reacting to industry changes with more internal actions and are now transitioning to look outward to share and access information with peers and test potential solutions.

Gathering and using first-party data is relatively new for over half of advertisers.

While it seems like the industry has been discussing and ideating on evolving privacy concerns and constraints for years, less than half of advertisers say they have been emphasizing gathering and analyzing first-party data for longer than six months. And 27% say their company has only just started to access more first-party data within the last six months (as of mid-2022).

These findings suggest that most advertisers have been lagging another segment of the industry that has taken quicker action related to these issues. Some of this lag may be partially due to Google moving their policy change deadline and advertisers continuing to use cookies. Yet clearly the trend is for advertisers to emphasize gathering and accessing more first-party data.